Phase 1.a

Match to order numbers and purchase orders for the bill to.

Phase 2 - Advanced autocomplete, "searchandizing," ability to combine content and products in results

Address anything we may have curtailed in Phase 1.x. This is likely to go hand in hand with a widget redesign. Ability to return mixed results? (I.e. - someone types 10 x 12 and hits Go, we can return stock offerings from multiple categories as broad exact matches (v. YMAC); or mix products and content "if the shoe fits.").

Research

Where are we now?

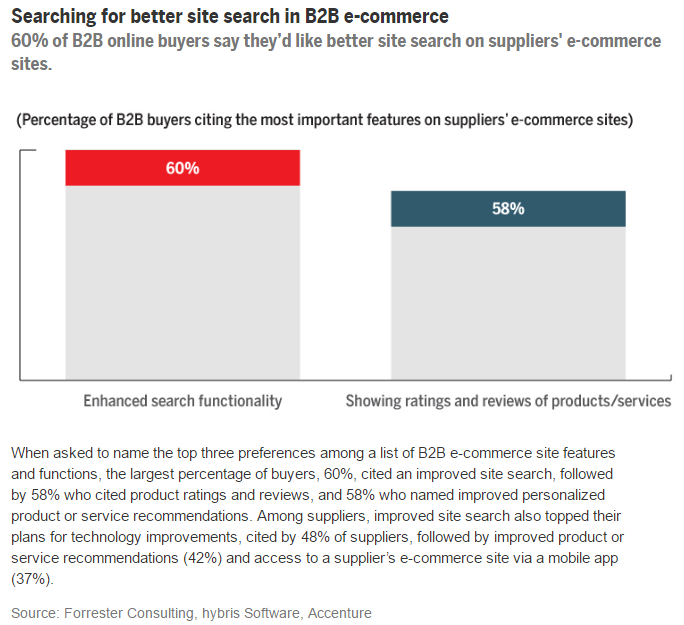

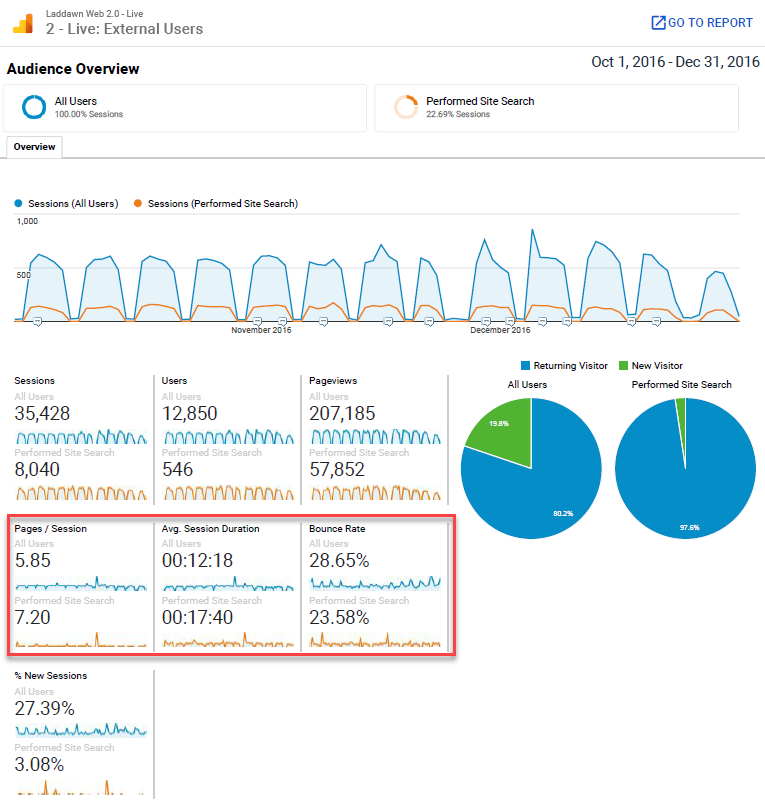

We offer a functional search box, likely a bit under-represented on the website. The only functionality it contains is the ability to search for item numbers or prior MOD numbers and in that respect, it works well. If we are to stay true to our mantra of replicating B2C functionality, then we need to enhance this materially. Research says (and our performance data supports, per Figure 1) that users who interact with site search tend to view more pages, stay on the site longer and bounce less (bounce is viewing one single page and leaving). If we have a more robust and easy-to-use search functionality in place, we have a good shot at improving these metrics even more.

FIGURE 1 - CURRENT USER INTERACTION, PERFORMED SITE SEARCH VS. NOT PERFORMED SEARCH

How many searches are users performing and what are they searching for?

Users used the search box X times in 2016. Of these, Y were Laddawn or customer part number searches, which the box is intended for, and Z were keyword searches, which we do not support...

Although both sets of searches consist of a "long tail" of unique search terms, some interesting patterns can be seen within each set.

Keyword searches

( This spreadsheet will serve as the basis for narrative, summary stats, etc. to be inserted here. Work still in process.

Part number searches

Current data (Figure 2) tells us that that reclosable 2 mil ziptops dominated our search in 2016. There's probably a few reasons for this:

- This could be a hint that reclosable zip tops are hard to find in the widget.

- It could be that it's one of our highest sellers and therefore prone to more searches.

- Or it could be that a lot of people simply know this part number and prefer to find their product this way.

In any one of these three scenarios, we have marketing opportunities. If we know a lot of people are searching for certain items on our site more than others, it might make sense to create additional awareness through blog posts, social media, Google AdWords and more. Because if they're typing it here, they're likely typing it into Google.

Further, we could use this data to promote these popular products elsewhere on our site, through cross-sells, banner ads, or targeted on-site content based on info we pull from our CRM. For example, wouldn't it be neat for a customer who buys a lot of these to log in and see a banner somewhere that promotes reclosable 2 mil ziptops?

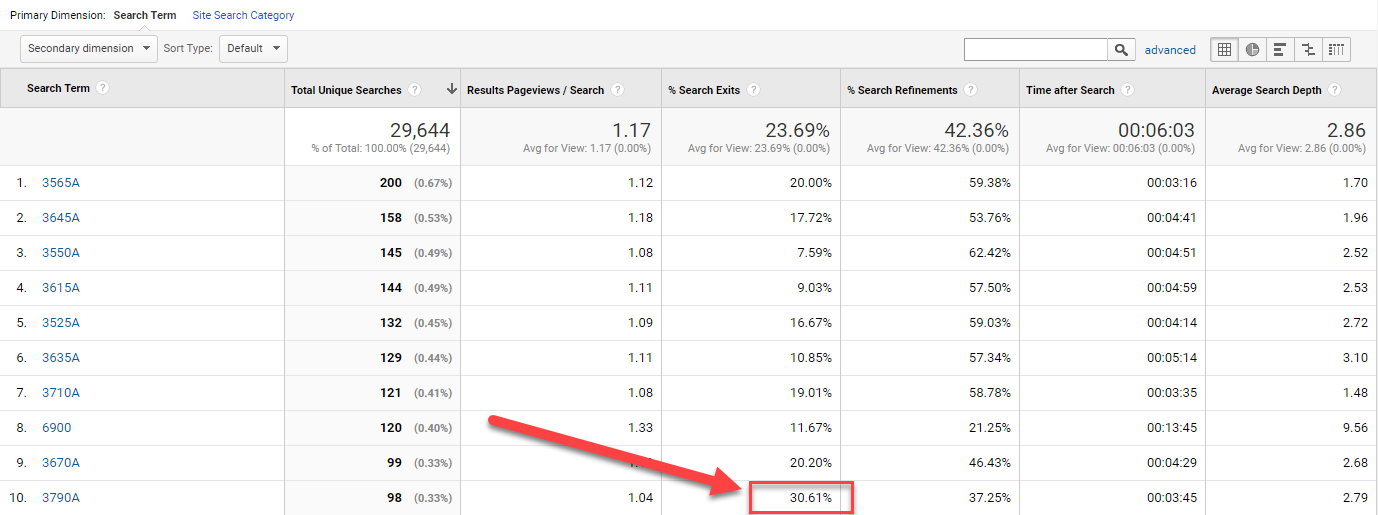

FIGURE 2 - TOP 10 SEARCH QUERIES, 2016

| Search Term | Product | Unique Searches | % Refinements |

| 3565A | Reclosable 2 mil Ziptop 4x6 | 200 | 59.38% |

| 3645A | Reclosable 2 mil Ziptop 9x12 | 158 | 53.76% |

| 3550A | Reclosable 2 mil Ziptop 3x5 | 145 | 62.42% |

| 3615A | Reclosable 2 mil Ziptop 6x9 | 144 | 57.50% |

| 3525A | Reclosable 2 mil Ziptop 2x3 | 132 | 59.03% |

| 3635A | Reclosable 2 mil Ziptop 8x10 | 129 | 57.34% |

| 3710A | Reclosable 4 mil Ziptop 4x6 | 121 | 58.78% |

| 6900 | Layflat 6mil on Rolls 38x72 | 120 | 21.25% |

| 3670A | Reclosable 2 mil Ziptop 12x15 | 99 | 46.43% |

| 3790A | Reclosable 4 mil Ziptop 12x15 | 98 | 37.25% |

NOTE: "Refinements" tells us what percent of the time people do a subsequent search on that particular query in the same online session. We also have the ability to see what subsequent keyword(s) a user typed.

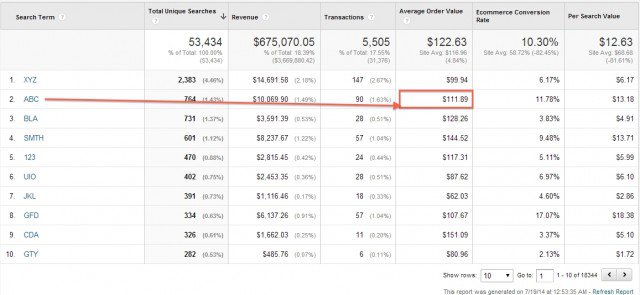

Data we haven't implemented yet will also help us tremendously with Site Search (Figure 3 & Figure 4). When we enable Google Analytics e-commerce tracking, it will open a whole new world of targeted merchandising and marketing options for us. Imagine if we knew how many transactions, how much revenue, the average order value, the conversion rate and the per search value per query on our site. Having that visibility will allow us to understand a LOT more about what our most valuable keywords are and what to focus on for content and marketing initiatives.

FIGURE 3 - OUR CURRENT GOOGLE ANALYTICS IMPLEMENTATION

FIGURE 4 - WHAT DATA LOOKS LIKE ONCE POPULATED

Further, in looking at Figure 4:

- What if we knew that a search for ABC product - the second most searched product on our site - had an average order value of $111.89 but had 1,619 fewer searches than XYZ product at $99.94. Don't you think we could do something with that information? We can. We can find a way to promote that product more since it drives a higher AOV.

- When people get used to being able to type in products and categories, we may even be able to gauge in-demand products that we DON'T carry.

- It could influence how we order/present our categories within the widget.

- If we ever wanted to promote related items, we could use this data to add marketing messages or graphics to results to create awareness. We recently launched Returnable Poly Mailers. If we could find a way to promote these when our users searched for perf or non-perf poly mailers, we could probably pick off some added sales.

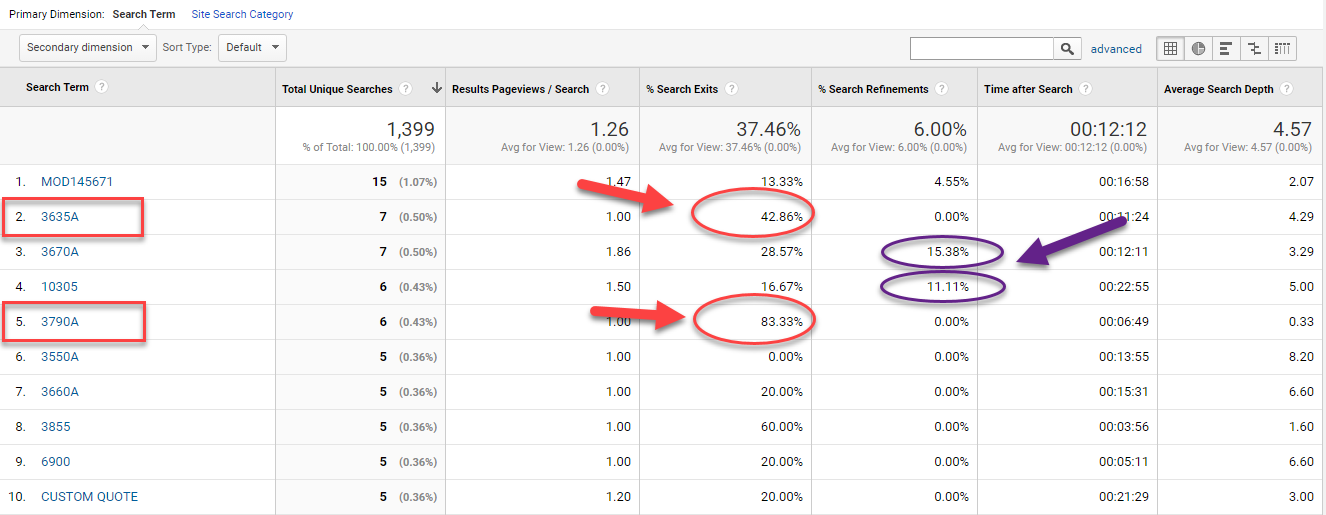

- We could also work to somehow improve the results or change/test something for the keywords that aren't performing as well. This would include keywords that have a high refinement rate (number of people who change/refine their search after performing one), a high search exit rate (number of people who leave the site after seeing results) and, when we have the data live, low conversion rate keywords from a revenue perspective. In Figure 5, you can see what I mean. We have two of our top 10 queries (in red) where the search exit rates are significantly higher than others in the top 10. We have two additional queries (in purple) where the search refinement percentage is much higher than average. These are the kinds of insights we'll need to take advantage of as we try to grow sales on the web. Every little last piece of conversion rate we can squeeze from our website grows our business.

FIGURE 5 - METRICS ON WHAT PEOPLE DO ONCE THEY SEARCH

(source, Google Analytics, Date Range October 1 - Dec 31, 2016)

You can see how much opportunity we have to make informed decisions here based on data - and also to create better user retention and user experience through an improved search experience. The focus of this exercise is to not only change how we do search, but to optimize closer to the money and reduce friction in getting visitors to what they want. There aren't many other places where we can shape the message based on someone telling us almost exactly what they want. Further, in addition to giving users a better experience, we'll get data. Lots of data. We will understand much better how people search and the english terms they use to find what they are looking for. We will learn what queries convert and what doesn’t and we'll apply those learnings to make the customer experience even better.

If we do this successfully, you have a better transaction for both parties, better user retention and a higher revenue per session average.

Functionality Ideas

Interesting list below of elements to consider, which I pulled from this article. Ones that are bold are ripe for conversation.

- Context – search should be personalized by who the user is (industry, company, role)

- Contract/Pricing – what products they can buy and agreed upon price

- Warehouse inventory

- Manufacturer part number

- Competitor cross reference

- Part number matching (strip out special characters)

- Automated spell check

- Past orders – search and filter based on what the user has purchased in the past

Add ability to search by keyword - ie, product category (layflat) and likely variants, while preserving ability to search by Laddawn or customer part number in same box.

What's the universe? Products only, or also content - catalogs, footer content, video, blogs, profiles, etc.? (Users will expect to be able to search anything.)

Do we combine this design effort with moving the search box into the widget, so that it is more tightly coupled with zip code? (Having search as a global element in banner on every page seems of limited value with our site structure...)

Natural language? Hmm. Maybe not so much, at least not initially? Seems like overkill. Are our users really likely to go to the trouble of typing (or using Siri-like services) to "Find me some lip and tape bags"? Where's the added value in this context? (we don't have a shred of data to support this, but I think a query like "are HD liners in stock in Iowa" would be a really nice user experience).

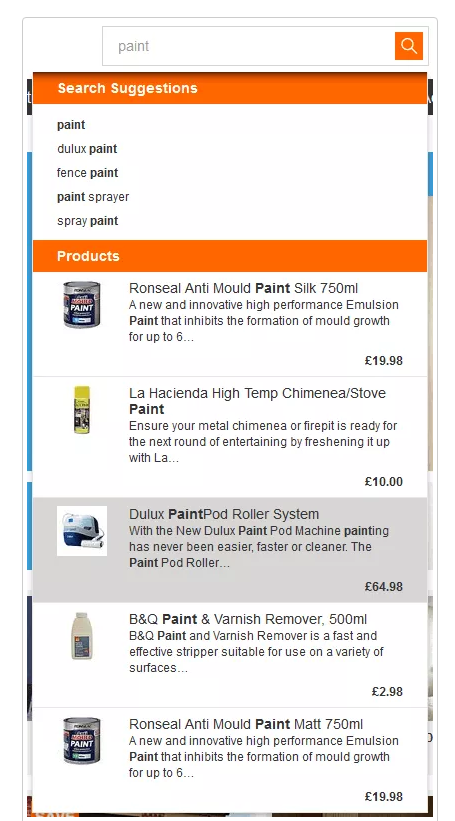

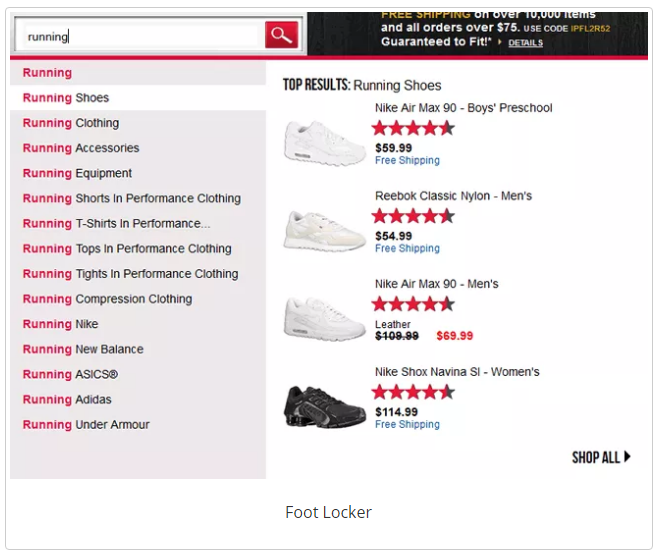

Predictive/autocomplete? (Suggests keywords as you type, perhaps even bound your choices?) Hugely valuable in mobile context too. Leveraging relevant details about our customer's purchase history to recommend other products is a good user experience and a boon for relevance and retention. The customer would love it.

Do we change any of the current rules in the widget to accommodate key word searches? For example, the widget category dropdown forces a choice between layflat and gusseted for a few categories. If just a keyword is entered, like "ice bag" - do we return all layflat and gusseted ice bags? Or do we force a choice via predictive suggestions? (This might be similar to the way travel sites force you to choice a specific airport, especially when a city (like London or NY) has more than one major airport.) I suppose we could do "Ice Bags - All" (like London airports - all airports).

More on autocomplate searches:

https://www.nngroup.com/articles/scoped-search/

https://uxmag.com/articles/designing-search-as-you-type-suggestions

http://baymard.com/blog/autocomplete-design

http://ui-patterns.com/patterns/Autocomplete

Sometimes the autocomplete "suggestions" are a bifurcated list of search terms + products (with images).

http://www.smileycat.com/search-auto-complete-design-gallery/

Ability to include dimensions? How to interpret free-form data entry variations?

X % of freeform searches in 2016 included dimensions. Some include " designation, some separate with "X" Some with spaces. Some express mils as .00n others as nMIL. Some express fractions with decimals; others with slashes (1/2).

Need a lot of intelligence around assumptions to make about dimensions entered alone, or combined with keywords. For example: If only two dimensions entered (without M, mil, mic, .000 etc.), we assume clear layflat bag (not sheet), of all gauges. If three dimensions entered, along with .002 or 2MIL, we assume gusseted two mil clear bag (not any other gusseted item).

If no dimensions entered, consider it a stock search?

Which aspects of Level 3 are out of scope? Materials or additives with secondary fields (% etc.). (For some can we make an assumption? E.g. let's say antistatic is a keyword; we assume it's the most common form of antistatic?) No Printing or Venting? Colored film? (Today we force the user to choose color v. tint v. opaque.) Packaging?

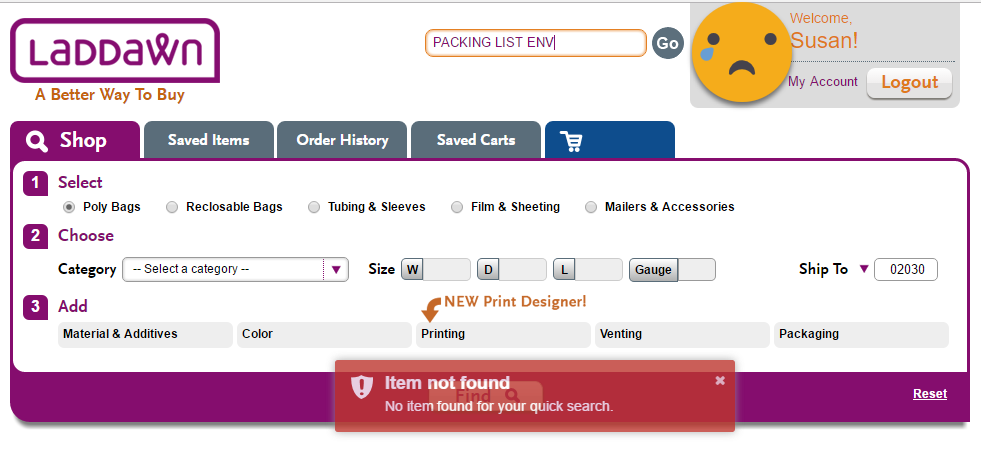

No Results

What do we do when we don't have results? After we launch, we will pull reports on a schedule with the goal of making some optimization changes. An example (Figure 6) could be below. This is a list of our top 10 searches - after we launch, there will be more "word" queries, so we'll have to imagine it for now. Notice that our 10th most used search query has a higher exit rate than the others (exit rate is % of people who leave the site right after performing a search). This is insight to potentially utilize. In this example, it means that over a third of the people who searched this keyword didn’t find what they were looking for, and left the site all-together. We'd want to improve that. In some cases, it could be that we don't carry it or it's out of stock, etc. In the event someone enters a search for something we don't carry or is out of stock, instead of showing just a red toaster with a short, cold "No results" message, we should enhance that toaster to show “related products” and/or a "temporarily out of stock" message if it's something we plan to carry again (do we need a mockup of this?)

FIGURE 6 - EXAMPLE OF SEARCH INSIGHTS WE CAN USE TO ENHANCE USER EXPERIENCE

Placement, Look and Feel

FIGURE 7 - THE TOP U.S. E-COMMERCE WEBSITES SEARCH BOX PLACEMENT

Commerce-driven sites tend to center their search boxes and a few add some color enhancements to call it out more clearly (Figure 7). I'm guessing there's a reason why these heavyweights all have a very similar search box implementation. Most appear to add some guided text within the box itself. We should consider the following:

- Increasing the size

- Keep the orange shading that we only see on the first visit to the Laddawn homepage on all the pages (consistency)

- Centering the search box

- Changing the label to "Find" or "Search" instead of "Go." The clearer the better.

We obviously recognize that a Laddawn search is a far more complicated task. We also know that 71% of our "Finds" that are executed on the widget are for just 4 categories (Figure 8). This should dictate some basic search merchandising. For example, an area below the search box of hot links for our most common search categories? (note - I need to research this further). This allows the 71% of people who come to the site to have the option of a quicker path to their product.

FIGURE 8 - MOST POPULAR FIND CATEGORIES, SEARCH WIDGET

| 101 - Poly Bags - Layflat | 28791 | 36.5% |

| 102 - Poly Bags - Gusseted | 11589 | 14.7% |

| 201 - Reclosable - Zip Top | 11458 | 14.5% |

| 301 - Tubing & Sleeves - Layflat Tubing | 4072 | 5.2% |

(source, Server Side Analytics, Date Range October 1 - December 31, 2016)

I think there are other merchandising opportunities here worth discussing. I like this screenshot of Home Depot where, when you type "saw blades" the most popular saw blades come up in photo form, with buying guides and category nav below it.

Build or Buy?

While we may be able to build something internally with our own developers who know our internal platform, there are some 3rd parties out there who could likely get us there much faster. These are the more popular site search vendors:

The typical implementation usually involves the vendor taking a data feed from us and using it to build results with the features you've seen here (auto-complete, spell-check, etc). Nextopia is one that I have experience with and I found it strong in some areas and a little weak in others - and I don't know about their capabilities to accommodate our very unique needs and UI for results. Costs, as you might imagine, depend on the level of work and ongoing assistance needed. SLI is a more enterprise level product and probably the most advanced here. All of these vendors can usually track conversions from their site search and can measure the ROI of the vendor investment. They also offer analytics and other management tools that enable us to have better control over what our users see. For example, we'd be able to create search "redirects" on our own, which is setting up certain queries to automatically trigger a specific find. We'd be able to dynamically add creative/banners or messaging to certain result sets. But again, this will need a much deeper dive regarding vendor capabilities. If there's a benefit to using a third party, it's that the tools are already built for us, we're using technology that has been shaped over years and we optimize and see benefits more quickly than if we built it.

I think all this is true for a Gardenia plant that you buy at a greenhouse or that you are maintaining, but when you order a flowering plant to be delivered for some special occasion, they are supposed to be about to burst into bloom.